Do you find it challenging to manage multiple payment options while ensuring a seamless transaction experience for your customers? In today’s digital marketplace, offering diversified payment solutions is vital for enhancing customer convenience and business growth. This article will guide you through various aspects of integrating multiple payment options, from customization of the checkout process to adhering to the latest security standards like PCI DSS v4.0. Let’s delve deeper into how these features can transform your business operations.

Multiple Payment Options

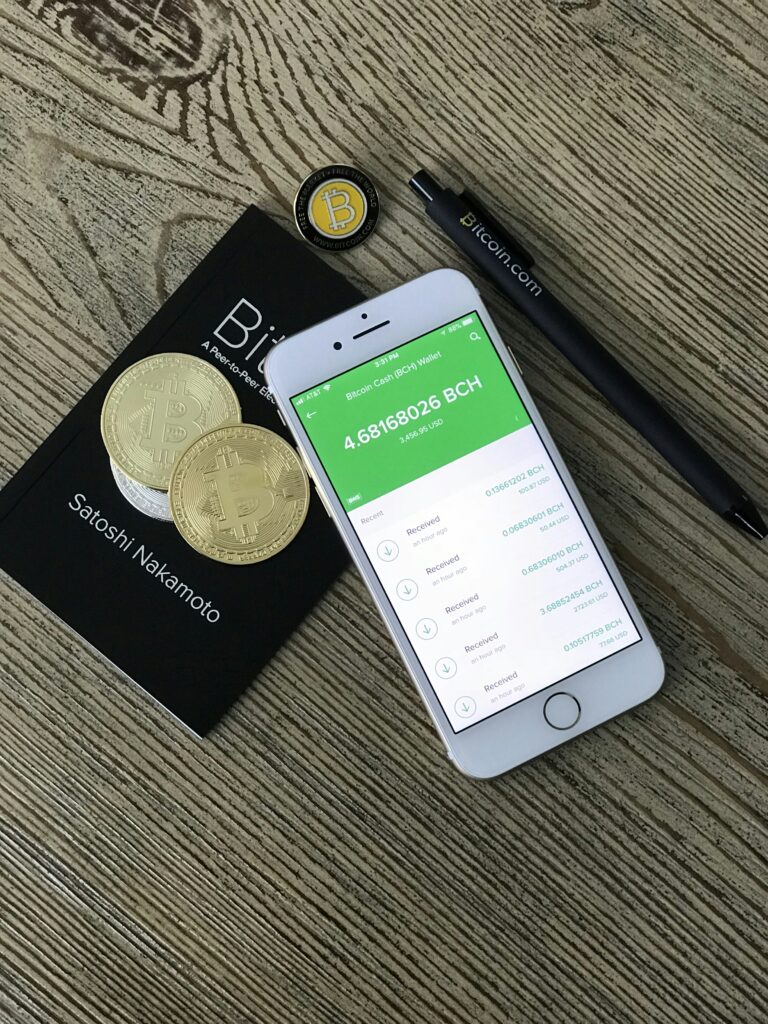

Offering a variety of payment methods not only meets customer expectations but also increases the convenience of transactions, leading to better conversion rates and customer satisfaction. It’s crucial to integrate multiple forms of payments such as credit cards, digital wallets, bank transfers, and even cryptocurrencies to cater to a broader audience.

Importance of Variety in Payment Options

By diversifying available payment methods, you cater to individual preferences and reduce the likelihood of cart abandonment. This strategy can potentially cover a wider market base, including those who may not have access to traditional banking services.

Implementing Diverse Payment Methods

Start by assessing the most popular payment methods among your target audience and integrate them efficiently into your system. It’s advisable to partner with payment processors that support a wide range of services to streamline this process.

Custom Checkout

Customizing the checkout process allows for a branded user experience and can significantly impact the perception of your brand. Tailoring this process to fit your brand increases trust and customer satisfaction.

Enhancing Brand Identity Through Checkout Customization

A consistent brand experience throughout the buying process strengthens your brand’s identity and enhances customer loyalty.

Steps to Customize Your Checkout Process

Consider elements such as layout, color scheme, and typography that resonate with your brand ethos. Also, simplify the process to reduce checkout time and include reassuring elements like security badges.

Card Authentication Using 3D Secure 2.0

One of the most effective ways to secure transactions and reduce fraud is by implementing 3D Secure 2.0. This newer version enhances user experience by minimizing disruptions during the authentication process.

Benefits of 3D Secure 2.0

It not only minimizes fraudulent transactions but also transfers the liability of fraud away from the merchant, offering a layer of protection against chargebacks.

Implementing 3D Secure 2.0

Integration typically involves coordination with your payment service provider to ensure it aligns with your existing payment gateway. Ensure you communicate with customers to educate them on how this security feature will affect their payment process.

Payment Requests

Utilizing direct payment links can significantly hasten the payment collection process. These links can be sent through various channels such as email, SMS, or even social media.

Accelerating Transactions with Payment Requests

Direct payment links simplify the process for customers to make payments without the hassle of navigating through the checkout process.

Creating Effective Payment Requests

Ensure that your payment requests are secure and include clear instructions on how the customer should proceed. Additionally, confirm that the links point directly to a secure and simple payment portal.

Customer Insights

Analyzing detailed reports and customer data can help you make informed decisions to optimize the customer experience and increase sales.

Importance of Data in Decision Making

Accurate data allows for better understanding of buying behaviors, preferences, and potential areas for improvement in your sales funnel.

Tools for Collecting and Analyzing Customer Data

Implement tools that can integrate with your existing systems to collect relevant data without disrupting the user experience. This might include analytics software or customer relationship management (CRM) systems.

Global Payment Processing

Being able to accept international payments opens your business to a global marketplace. This requires an understanding of currency exchange, international payment laws, and optimal user experience regardless of location.

Challenges in Global Payment Processing

Navigating different currency exchanges and transaction fees can be complex. Ensuring compliance with international payment laws is also critical.

Strategies for Effective Global Payments

Choose payment platforms that offer global payment capabilities with a focus on security and compliance. Also, consider local preferences in payment methods to increase acceptance rates.

Revenue Optimization

Incorporating tools and strategies to enhance profitability isn’t just about increasing sales; it’s also about optimizing the processes around those sales.

Understanding Revenue Optimization

It involves analyzing transactions and user behavior to identify patterns that lead to higher sales and better customer retention.

Tools for Revenue Optimization

Employ data analytics and segmentation tools to pinpoint areas where small changes can result in significant profit increases. Also, optimize user journeys to ensure maximum conversion rates.

PCI DSS v4.0 Compliance

With online security threats evolving, adhering to the latest Payment Card Industry Data Security Standard (PCI DSS v4.0) is crucial in protecting customer information and ensuring transaction security.

Changes in PCI DSS v4.0

The new standard is set to introduce more rigorous compliance measures and adapt to the changing dynamics of payment security.

Preparing for PCI DSS v4.0

Begin by auditing your current security protocols against the new requirements. Training for your team and technology updates might be necessary to ensure compliance.

Integration Services

Having comprehensive support for integrating various payment systems can reduce the administrative burden and potential errors associated with manual integrations.

Benefits of Professional Integration Services

These services ensure that multiple payment systems work seamlessly together, enhancing the efficiency of transactions.

Finding the Right Integration Partner

Choose partners who have a proven track record and who understand your specific business needs. Ensure they offer ongoing support and are up-to-date with the latest technology standards.

Earn from Referrals

Referral programs can be a lucrative way for agencies to earn by recommending robust payment solutions.

How Referral Programs Work

Agencies earn commissions or benefits by referring new customers to payment services, which can lead to a steady passive income stream.

Best Practices for Referral Success

Choose reputable and reliable payment services to endorse, ensuring that the services you recommend are genuinely beneficial to your referrals.

By understanding and implementing the above elements in your payment integration strategy, you not only enhance your customer’s experience but also reinforce the stability and profitability of your business. Remember, the goal is to provide seamless, secure, and efficient transactions that align with your brand identity and business objectives. With the proper approach to multiple payment options, customized checkouts, and strategic partnerships, your business is well on its way to delivering a superior service that aligns with contemporary consumer expectations and the demand for technological integration in financial operations.